Monthly Update, October 2023

View Tearsheets here: PERFORMANCE DETAILS

Click here to view the latest presentation.

The Big Picture

Soaring Pelican is coming up on 13 years since inception. One fact that we live with every day is that our performance is dictated by the levels of volatility in the S&P. Since 2011 we have been swimming upstream against a flood of cash from the Fed (Quantitative Easing) which has dampened the natural volatility that should exist in an open market. Fortunately, that changed in 2022.

Quantitative Tightening (QT) began in early 2022 and it effectively broke the 13+ year uptrend. 2022 marked an inflection point and now the playing field has shifted. We see a real opportunity here.

Our bread-and-butter trades have kept us in business over the years, but now that dampening of the Fed has lifted, the potential for home run trades is real. Who doesn't love one of those?

We continue to grind away with a focus on risk so that our clients (some of them with us for more than 10 years!) can leverage the incredible power of notional funding to strategically magnify results.

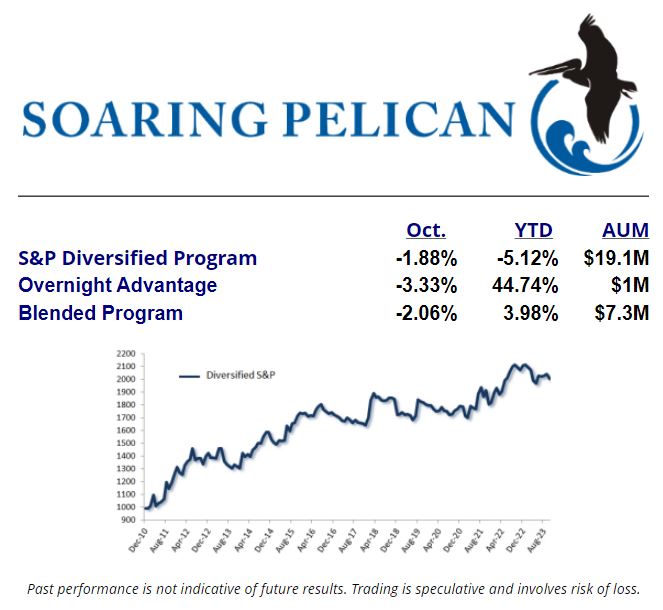

Recent Program Performance

All CTA indices declined in October, likely due to declining volatility throughout most of the month. Our programs also retreated into a typical pullback. The market made two major reversals which did not give us the opportunity to enter (we do not try to call major tops and bottoms). It is rare that both the intraday and overnight timeframes have a losing month, but it does happen.

Our Outlook

This long-term rangebound market environment coupled with higher volatility is setting the stage for excellent trading. Volatility has reached the highest levels in 12 months and we are coming into a period where historically our returns have been strongest. We are ready!

Best regards,

Sam Beckers and Dario Michalek

Soaring Pelican, LLC

805-322-7393

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. FUTURES TRADING IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK.